In today’s digital landscape, a robust online presence is crucial for any e-commerce business. A key component of this presence lies in facilitating seamless and secure online transactions. This requires a comprehensive understanding of two fundamental elements: payment gateways and merchant accounts. This article provides a clear explanation of these essential tools, decoding their functionalities and highlighting their importance for successful e-commerce operations. We’ll explore how these systems work together to enable businesses to accept online payments, manage transactions, and ultimately drive revenue growth. Whether you’re a seasoned online retailer or just starting out, understanding payment processing is vital for success.

Navigating the world of e-commerce payment solutions can be complex. This article aims to demystify the process by breaking down the intricacies of payment gateways and merchant accounts. We’ll clarify the distinctions between these two crucial components and explain how they interact to authorize and settle online payments. We’ll also delve into the various types of payment gateways and merchant accounts available, enabling you to make informed decisions when choosing the right solution for your e-commerce business. By grasping the fundamentals of payment processing, you can optimize your online sales strategy and ensure a smooth and secure checkout experience for your customers.

What is a Payment Gateway?

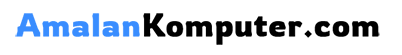

A payment gateway is a technology that acts as a bridge between your online store and the payment processor. It securely authorizes credit card and other electronic payments for e-commerce businesses. Think of it as the virtual equivalent of a physical point-of-sale terminal in a brick-and-mortar store.

When a customer makes a purchase online, the payment gateway encrypts the sensitive payment information and transmits it securely to the payment processor for verification. It then relays the authorization or decline back to the merchant, allowing the transaction to be completed or cancelled. This entire process happens within seconds, providing a seamless checkout experience for the customer.

Key functions of a payment gateway include:

- Encryption: Protecting sensitive payment data.

- Authorization: Verifying funds availability.

- Settlement: Transferring funds to the merchant account.

How Does a Payment Gateway Work?

A payment gateway acts as a secure bridge between your online store and the payment processor. Think of it as the digital equivalent of a physical point-of-sale terminal.

When a customer makes a purchase, their payment information is encrypted and securely transmitted to the payment gateway. The gateway then communicates with the payment processor (like Visa, Mastercard, or American Express) to authorize the transaction.

The payment processor checks with the customer’s issuing bank to ensure sufficient funds. Once approved, the authorization is relayed back to the payment gateway, then to your website, and finally to the customer, confirming the purchase.

This entire process happens within seconds, providing a seamless checkout experience for the customer. The gateway then facilitates the transfer of funds from the customer’s account to your merchant account.

What is a Merchant Account?

A merchant account is a special type of bank account that allows businesses to accept payments via credit and debit cards. Think of it as a holding area for customer funds before they are transferred to your business’s regular bank account. It’s essentially an agreement between your business, a payment processor, and an acquiring bank.

The acquiring bank assumes the risk associated with processing card payments, such as chargebacks or fraud. The merchant account is where the funds are initially deposited after a customer makes a purchase. From there, the funds are settled into your business bank account, typically within a few business days, after deducting processing fees.

Why Do You Need a Merchant Account?

A merchant account is crucial for accepting online payments. It acts as a dedicated business bank account for processing credit and debit card transactions from your customers. Think of it as the bridge between your business and the complex world of payment processing.

Without a merchant account, the funds from your customer’s purchases wouldn’t have a designated place to land before being transferred to your regular business bank account. Security and compliance are also significant factors. Merchant accounts are equipped to handle sensitive payment data securely and adhere to Payment Card Industry Data Security Standards (PCI DSS).

Reduced chargebacks are another benefit. Having a merchant account demonstrates a level of legitimacy and established business practices which can help mitigate disputes and fraudulent transactions. Finally, merchant accounts offer faster processing times, meaning you’ll receive your funds more quickly than using alternative methods.

How to Choose the Right Payment Gateway and Merchant Account

Selecting the right payment gateway and merchant account is crucial for your e-commerce business’s success. Consider these key factors when making your decision:

Payment Gateway Selection

Transaction fees are a primary concern. Compare different providers and their pricing structures, including per-transaction fees, monthly fees, and any other charges.

Supported payment methods should align with your target audience. Ensure the gateway supports the cards and digital wallets your customers prefer.

Security features are paramount. Look for gateways with robust fraud prevention tools and PCI DSS compliance.

Integration with your existing e-commerce platform should be seamless. Check for compatibility and ease of integration.

Merchant Account Selection

Processing rates are key to your profitability. Compare rates and negotiate for the best terms.

Contract terms should be carefully reviewed. Pay attention to early termination fees and other restrictions.

Customer support is vital if issues arise. Choose a provider with responsive and reliable support.

Reputation and stability of the provider are important factors. Research the provider’s track record and financial stability.

Understanding Payment Processing Fees

Navigating the world of payment processing fees can seem complex, but understanding the key components is crucial for managing your e-commerce business’s finances. Essentially, every time a customer makes a purchase through your online store, several parties are involved, each taking a small cut.

The three primary fees you’ll encounter are:

- Interchange fees: Paid to the card-issuing bank (e.g., Visa, Mastercard). These fees vary depending on the card type (debit, credit, rewards) and the transaction specifics.

- Assessment fees: Charged by the card networks themselves (Visa, Mastercard, etc.) for using their infrastructure. These are typically a small percentage of the transaction.

- Processor markup: This is the fee your payment processor charges for their services, which includes transaction processing, security, and customer support. This can be a flat fee per transaction, a percentage, or a combination of both.

Being aware of these fees allows you to accurately calculate your profit margins and choose the best payment processing solution for your business needs. It’s essential to compare different providers and understand their fee structures before making a decision.

Ensuring Payment Security and Compliance

Security and compliance are paramount when accepting online payments. PCI DSS (Payment Card Industry Data Security Standard) compliance is non-negotiable. This standard outlines requirements for securing cardholder data to prevent fraud and data breaches. Your payment gateway provider should be PCI DSS compliant, but you also have responsibilities to maintain compliance within your own systems.

SSL certificates are essential for encrypting data transmitted between your customer’s browser and your server. Look for the padlock icon in the browser’s address bar to confirm a secure connection.

3D Secure authentication adds an extra layer of security by requiring customers to verify their identity through a password or one-time code. This helps prevent unauthorized transactions.

Address Verification Service (AVS) and Card Verification Value (CVV) checks help verify the cardholder’s identity and reduce the risk of fraudulent transactions. These tools compare the information entered by the customer with the information on file with the card issuer.

Regular security audits and vulnerability scanning are crucial to identify and address potential weaknesses in your systems. Staying up-to-date with the latest security best practices is essential for protecting your business and your customers.

Integrating Your Payment Gateway with Your E-Commerce Platform

Integrating your chosen payment gateway with your e-commerce platform is a critical step in enabling online transactions. Most platforms offer pre-built integrations with popular payment gateways, simplifying the process considerably.

Typically, integration involves configuring API keys and other credentials within your platform’s settings. Your payment gateway provider will supply these necessary details. Carefully follow their instructions for a smooth integration.

Once integrated, the payment gateway becomes a seamless part of your checkout process. Customers can select their preferred payment methods and complete their purchases without leaving your website.

Testing the integration is essential before going live. Conduct test transactions to confirm that payments are processed correctly and data flows seamlessly between your platform and the payment gateway.

If your platform doesn’t offer a pre-built integration, you may need to consider custom development or plugins. Consult with your platform provider and payment gateway support for guidance.

Troubleshooting Common Payment Issues

Encountering payment issues can be frustrating for both businesses and customers. Here are some common problems and how to address them:

Declined Transactions

Declined credit cards are often due to insufficient funds, incorrect card details, or expired cards. Promptly inform the customer and advise them to check their information or contact their bank.

AVS Mismatches

Address Verification System (AVS) mismatches occur when the billing address provided by the customer doesn’t match the card issuer’s records. Requesting the customer to double-check their address or use an alternative payment method can resolve this.

CVV Errors

Card Verification Value (CVV) errors indicate the customer entered the wrong three or four-digit security code. Ask them to verify the code and try again.

Processing Errors

General processing errors can stem from technical issues with the payment gateway or merchant account. Contact your provider immediately to investigate and rectify the problem.

Chargebacks

Chargebacks arise when a customer disputes a charge with their bank. Maintaining clear communication with customers and providing detailed transaction information can help prevent and resolve chargebacks.

Benefits of Using a Payment Gateway and Merchant Account

Leveraging a payment gateway and merchant account offers numerous advantages for e-commerce businesses. These tools streamline operations and contribute to enhanced profitability and customer satisfaction. Here are some key benefits:

Increased Sales and Revenue

By accepting a wider variety of payment methods, including credit and debit cards, businesses can cater to a larger customer base, potentially leading to increased sales and revenue. This broadened accessibility removes barriers to purchase and contributes to a more seamless checkout experience.

Improved Cash Flow

With efficient processing times, funds are deposited into your merchant account more quickly, improving cash flow and enabling businesses to reinvest capital back into their operations. This faster access to funds contributes to greater financial flexibility.

Enhanced Security

Security is paramount in online transactions. Payment gateways employ advanced security measures to protect sensitive customer data, reducing the risk of fraud and chargebacks. This protection builds trust with customers and safeguards the business’s reputation.