In today’s digital marketplace, a robust and reliable e-commerce payment gateway is crucial for the success of any online business. This comprehensive guide delves into the complexities of e-commerce payment gateways, providing valuable insights for businesses seeking to optimize their online transaction processes. Understanding how these gateways function, the various types available, and the key factors to consider when selecting one can significantly impact your business’s bottom line. From payment processing and security to customer experience and conversion rates, we will explore the essential aspects of e-commerce payment gateways to empower you to make informed decisions.

This guide will decode the intricacies of e-commerce payment gateways, covering topics such as payment methods, fraud prevention, and integration with popular e-commerce platforms. Whether you are launching a new online store or seeking to improve your existing payment infrastructure, this resource will equip you with the knowledge needed to navigate the world of online payments effectively. We will explore the benefits and drawbacks of different gateway solutions, helping you choose the optimal e-commerce payment gateway to meet your specific business needs and enhance your online sales.

What is a Payment Gateway and Why Do You Need One?

In the simplest terms, a payment gateway is a technology that acts as a bridge between your online store and the payment processor.

Think of it as the digital equivalent of a physical point-of-sale terminal in a brick-and-mortar store. It securely authorizes payments from customers purchasing goods or services on your website or app.

Why is it crucial for your e-commerce business? Because it enables you to accept payments online, which is essential for generating revenue. Without a payment gateway, customers wouldn’t be able to complete purchases, and your online store would be effectively non-functional.

Payment gateways protect sensitive customer data by encrypting credit card details and other personal information during transmission. This safeguards both your customers and your business from fraud and data breaches. They also streamline the transaction process, making it quick and easy for customers to pay, leading to increased sales and improved customer satisfaction.

How Payment Gateways Work: A Step-by-Step Process

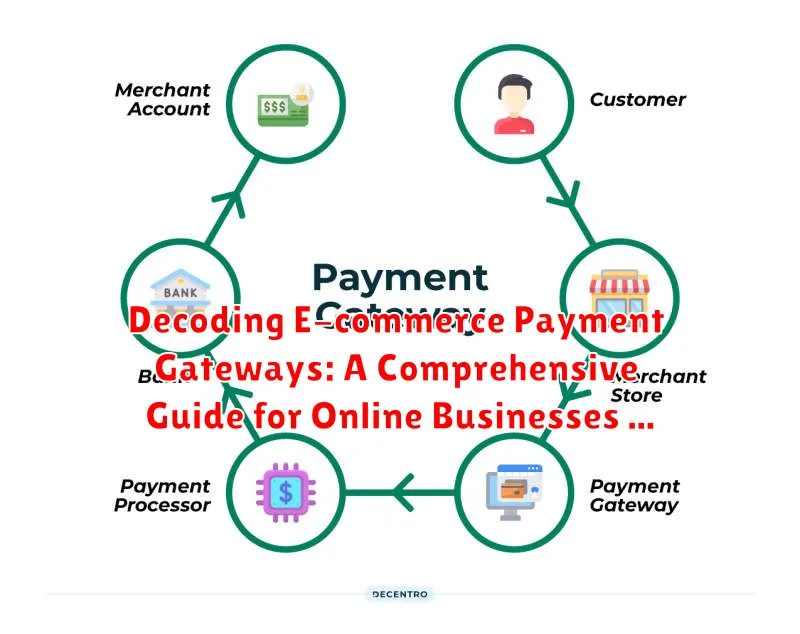

A payment gateway facilitates the secure transfer of payment information between a customer and a merchant during an online transaction. Here’s a breakdown of the process:

-

Customer Initiates Payment: The customer proceeds to checkout after selecting their desired products or services.

-

Payment Information Submission: The customer enters their payment details, such as credit card number, expiry date, and CVV, on the merchant’s secure checkout page.

-

Encryption and Transmission: The payment gateway encrypts the sensitive payment information and transmits it securely to the payment processor.

-

Authorization Request: The payment processor forwards the transaction details to the customer’s issuing bank for authorization.

-

Authorization Response: The issuing bank verifies the customer’s funds and sends an authorization response (approved or declined) back to the payment processor.

-

Merchant Notification: The payment gateway relays the authorization response to the merchant, informing them whether the transaction was successful.

-

Funds Capture: Once the transaction is authorized, the merchant can capture the funds and complete the order fulfillment process.

Different Types of Payment Gateways Available

E-commerce businesses can choose from a variety of payment gateways, each offering distinct features and functionalities. Understanding these differences is crucial for selecting the optimal solution.

Hosted Payment Gateways

With hosted payment gateways, customers are redirected to a third-party payment page to complete their transaction. This option simplifies PCI compliance for merchants as sensitive payment information is handled off-site. A potential drawback is a less seamless customer experience due to the redirection.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to enter payment information directly on the merchant’s website. While this offers a more integrated and branded checkout experience, it increases the merchant’s PCI compliance responsibilities.

API Hosted Payment Gateways

API hosted gateways offer a balance between control and security. Merchants integrate the gateway’s API into their platform, allowing for a customized checkout process while leveraging the gateway’s secure infrastructure for processing payments.

Local Bank Integrators

These gateways connect directly to a local bank, providing a streamlined payment option for customers within that bank’s network. This approach can simplify transactions and potentially reduce processing fees for both merchants and customers.

Key Features to Look for in a Payment Gateway

Selecting the right payment gateway is crucial for a smooth and secure checkout experience. When evaluating providers, prioritize these key features:

Security

Robust security measures are paramount. Look for gateways offering PCI DSS compliance, fraud prevention tools, and data encryption to protect sensitive customer information.

Accepted Payment Methods

Supporting a wide range of payment methods is essential for catering to diverse customer preferences. Consider gateways that accept major credit and debit cards, digital wallets, and other relevant options for your target market.

Transaction Fees

Understand the fee structure. Compare transaction fees, monthly fees, and any other associated costs to determine the most cost-effective solution for your business.

Integration and Compatibility

Seamless integration with your existing e-commerce platform and other business tools is vital. Ensure compatibility and ease of setup to streamline operations.

Customer Support

Reliable customer support is essential for troubleshooting any issues. Look for providers offering responsive and accessible support channels.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is crucial for a seamless checkout experience and successful online business. Several factors should influence your decision. Prioritize your specific business needs and consider the following aspects.

Transaction Fees and Costs

Transaction fees are a primary consideration. Different gateways have different fee structures, including per-transaction fees, monthly fees, and setup fees. Analyze your average transaction value and sales volume to determine the most cost-effective option.

Supported Payment Methods

Offering diverse payment methods enhances the customer experience. Consider which payment options are essential for your target audience. This may include credit cards, debit cards, digital wallets (like Apple Pay or Google Pay), and other regional payment systems.

Security Features

Security is paramount. Look for gateways with robust fraud prevention tools, PCI DSS compliance, and advanced encryption technologies to safeguard your customer’s sensitive data.

Integration with Your Platform

Seamless integration with your existing e-commerce platform simplifies operations. Ensure the gateway is compatible with your website’s framework and other business tools.

Customer Support

Reliable customer support is vital for troubleshooting any payment processing issues promptly. Consider the availability and quality of support offered by the payment gateway provider.

Integrating a Payment Gateway with Your E-commerce Platform

Integrating a payment gateway is crucial for accepting online payments. The process typically involves choosing a suitable gateway and then integrating it with your platform.

Selection: Factors to consider include transaction fees, supported payment methods, security features, and compatibility with your platform. Research different gateways to find the best fit for your business needs.

Integration: Most gateways offer detailed documentation and APIs for integration. Generally, you’ll need to create an account with the payment gateway provider and then configure the connection within your e-commerce platform’s settings. This may involve entering API keys, configuring webhooks for notifications, and setting up payment methods.

Testing: After integration, thoroughly test the payment process. Conduct test transactions to ensure payments are processed correctly and that data flows smoothly between your platform and the gateway. Verify successful transaction completion, refunds, and other payment functionalities.

Security Considerations for Payment Gateways

Security is paramount when choosing and implementing a payment gateway. Protecting customer data and minimizing fraud are crucial for maintaining trust and business integrity.

PCI DSS Compliance is a must. Ensure your chosen gateway adheres to the Payment Card Industry Data Security Standard. This standard outlines requirements for handling sensitive cardholder data.

Tokenization replaces sensitive card data with unique tokens, reducing the risk of data breaches. Look for gateways that offer robust tokenization services.

3D Secure (3DS) adds an extra layer of authentication for online transactions. By requiring cardholders to verify their identity with their bank, 3DS helps prevent unauthorized purchases.

Fraud prevention tools are essential. Consider gateways that offer features like address verification, velocity checks, and fraud scoring to identify and block suspicious transactions.

Regular security audits and penetration testing can help identify vulnerabilities and strengthen your system’s defenses. Prioritize providers who proactively address security concerns.

Troubleshooting Common Payment Gateway Issues

Encountering payment gateway issues can be frustrating for both businesses and customers. Addressing these promptly is crucial for maintaining a smooth checkout process. This section outlines common problems and potential solutions.

Transaction Declines

Declined transactions are a frequent issue. Often, this is due to insufficient funds, incorrect card details, or expired cards. Ensure clear error messages are displayed to the customer, guiding them to rectify the issue. Verify with your payment gateway provider if there are any issues on their end.

Authorization Failures

Authorization failures can stem from security flags triggered by the payment gateway or the customer’s bank. Addressing this might involve contacting the customer to verify the transaction or working with the payment gateway to understand the reason for the decline.

Connectivity Problems

Intermittent connectivity issues can disrupt transactions. Check your internet connection and ensure your payment gateway integration is stable. Regularly monitor your gateway’s status page for reported outages.